Premises Policies for Commercial Lenders

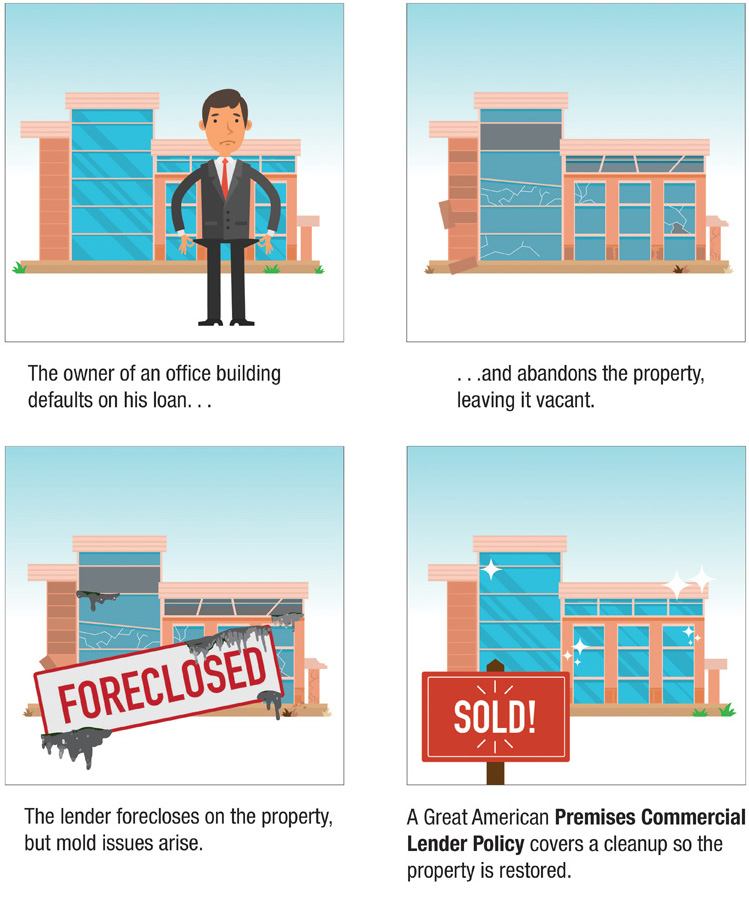

Great American offers premises coverage for commercial lenders who desire to protect their financial interest in a property or properties in the event of a pollution condition arising after default or foreclosure of a property. Target accounts include properties with a lender interest that may be environmentally impacted or where there may be future liability that could be tied to the borrower.

Coverage provided under the lender policy is similar to our standard premises policy with some important differences. In addition to clean-up costs and legal liability associated with a pollution condition, the lender policy has built in diminution in value and collateral protection coverage. The coverage under a premises commercial lender policy may provide the lender with value where a pollution condition may have eroded the value of collateral assets, litigation may have ongoing or future costs, or cleanup is required to remediate a property before it can be sold.

Great American now has an application designed specifically for commercial lenders. This application includes the standard questions asked for quoting commercial lender premises policies including questions regarding loan details, borrower information and financials, and collateral description and future use. The new Application for Commercial Lenders can be found on our Applications and Forms page under the General Applications category.

For more information on our stand-alone site pollution policy, feel free to review this article from our July newsletter.

Kevin Rega

Kevin Rega is a Production Underwriting Supervisor with Great American’s Environmental Division. He is a licensed professional geologist with the Commonwealth of Pennsylvania, has over a decade of environmental consulting experience, and a graduate level education with a focus on hydrogeology. Kevin brings his technical experience to his underwriting approach and is based out of our Exton, Pennsylvania office.”