Environmental Evaluation of Dry-Cleaning Industry

Adaptability is commonly known as a key success factor in the dry-cleaning industry. As a result of its long history, widespread presence and many well-known environmental concerns, dry-cleaning professionals have grown accustom to inheriting demanding business practices that adhere to ever-evolving industry standards.

Although the dry-cleaning industry is highly fragmented and numerically in decline, it is still widespread across the United States and faces an increasingly stringent environmental regulatory burden.

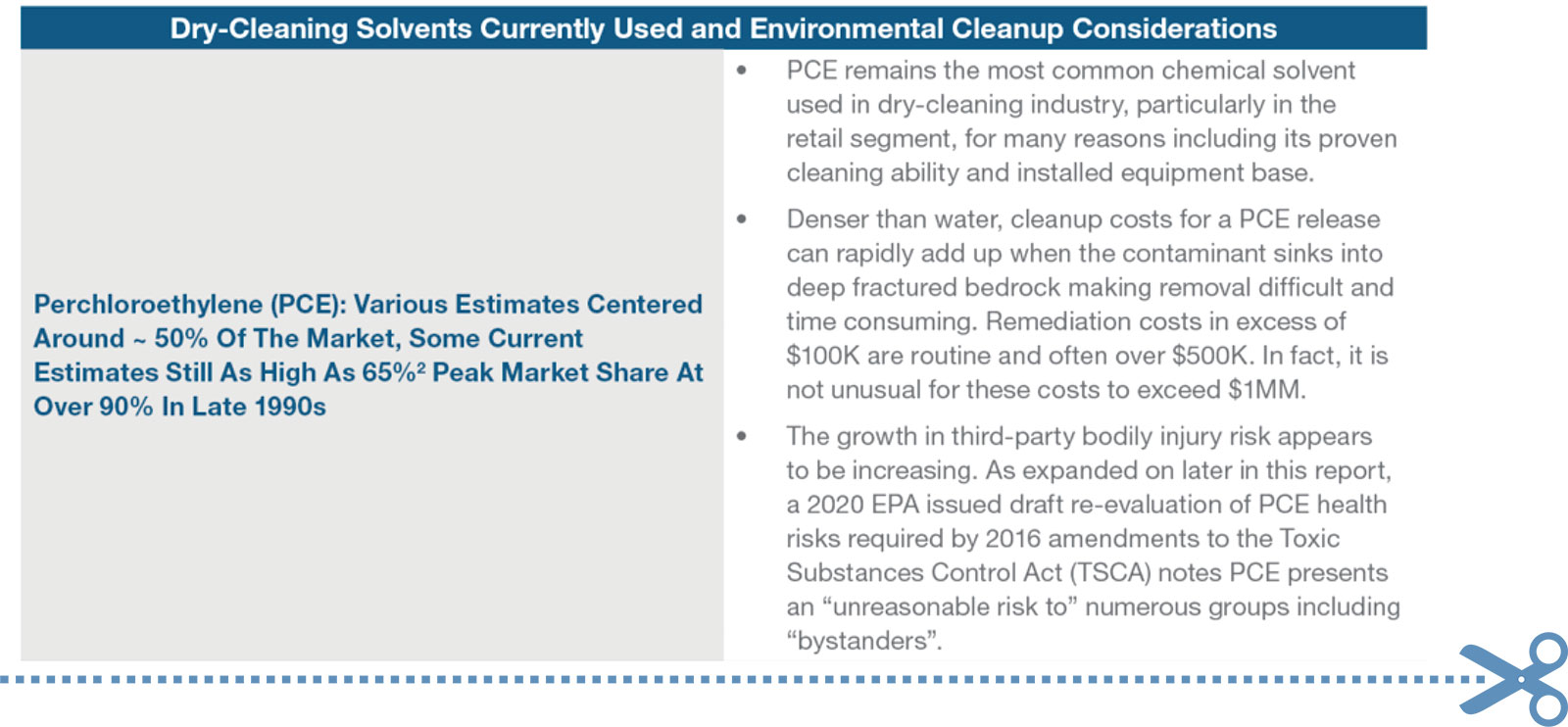

Solvents – Background, Current Types

The first dry-cleaning businesses reportedly started in Paris, France circa 1820 and in the U.S. circa 1840. Initially, the use of low flash point, highly flammable, petroleum-based solvents led to most facilities being located outside of cities due to the increased fire hazard they posed. To reduce this hazard, the U.S. Department of Commerce required dry-cleaning solvents to have a minimum 100-degree flash point in 1928. This led to a rapid switch to Stoddard Solvent which met the new requirement. PCE, which is non-flammable, was reportedly first used in the industry in the early 1930s1. The perceived safety of PCE led to its rapid and widespread growth of usage throughout the industry.

There are several additional new solvents in use including:

- Glycol ethers

- Rynex Holdings, LTD developed the solvent marketed as Rynex in 1995.

- Solveair (aka Solvair), a dual system of cleaning with Glycol Ether and extraction with liquid CO2.

- Impress, introduced by the Lyondell Chemical Company in 2004.

- DrySolv™ (n-propyl bromide) introduced by Enviro Tech International in 2006.

- Solvon K4 (dibutoxymethane) introduced by Kreussler in 2010.Solvon K4 is listed as a possible ‘Dangerous Waste’ in Washington State3.

- New, high flash-point synthetic petroleum solvents.

As the dry-cleaning market continues to evolve, New York has taken additional regulatory precautions. Any dry-cleaner solvent used in New York must be approved prior to use. Machines using only water or liquid carbon dioxide are not regulated. The NYS DEC website lists over a dozen state approved solvents other than PCE.

Some reliable old solvents reportedly still in use for isolated niche applications include:

- Benzene

- White gasoline

- Stoddard solvent

- Higher 140 flash solvents

Importantly, ‘green’ dry-cleaning has come to mean any dry-cleaning process that does not use PCE. As a result, even petroleum-based dry-cleaning solvents are commonly marketed as being ‘green’. Environmental considerations for the various new niche solvents have largely not been evaluated to date. Environmental considerations for the older existing solvents are expected to largely mimic those of the hydrocarbons group.

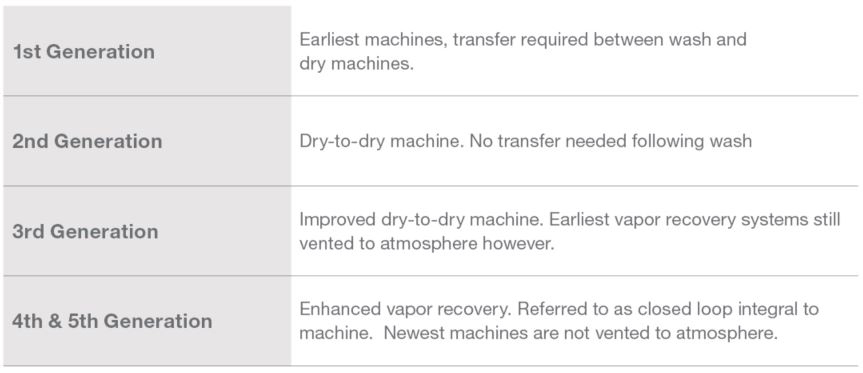

Industry Equipment

After WWII, smaller equipment and safer solvents allowed the industry to move into city centers and other populated areas. Modern dry-cleaning machines have undergone steady improvements.

Machines are commonly referred to by design generation:

Industry Establishments

The dry-cleaning industry is highly fragmented with no single operator accounting for more than 2.0% of industry revenue, and the top 50 industry operators estimated at less than 9.0%.

The industry has undergone significant restructuring over the past five years, with what were once-major companies downsizing considerably or exiting the industry altogether. US Dry Cleaning Services Corporation, which owned more than 40 locations across the Country in 2018, is nearly nonexistent with stores shuttering without notice to customers or the community. Its website currently consists of a single webpage noting all locations are currently closed due to COVID-19.

A challenge many industry entrants face is increasing their market share. For this reason, we see a limited number of large or chain dry-cleaning companies and many smaller, mom and pop dry-cleaners.

"The barriers to entry into this space – to get up and running and start serving a handful of customers – are pretty low. It's the barriers to scale that are incredibly high," Ajay Prakash, Co-founder and CEO of Rinse, said.

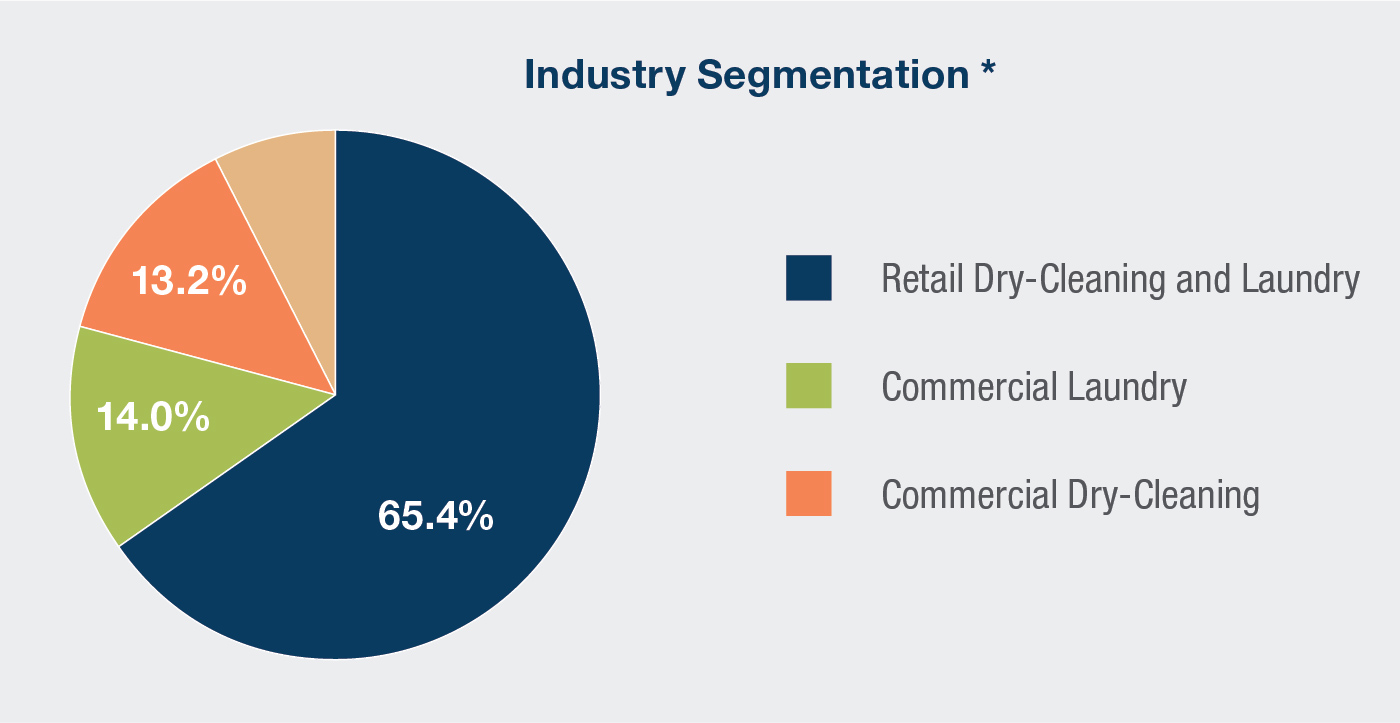

Industry Segmentation

Dry-cleaning falls under NAICS 8123: “Drycleaning and Laundry Services” and more specifically as NAICS 812320.

NAICS industry descriptions are divided into three groups:

- Retail dry-cleaning and laundering services; includes drop-off and pick-up sites and those offering specialty cleaning such as for furs, wedding gowns, draperies and more

- Coin-operated laundry facilities

- Commercial companies that generate the majority of its revenue from linen and uniform rentals

IBISWorld further segments the industry by breaking out commercial into laundry services and dry-cleaning services.

The largest commercial clients of full-service laundry are hospitals, restaurants, and hotels. Over the next five years, hospitals are expected to experience robust demand because of rising per capita healthcare expenditure. Prior to COVID-19, demand from the hospitality industry was expected to similarly rise as the trend of Americans dining out and taking domestic trips has risen. It is unclear how much the growth in each of these markets will drive corresponding growth in commercial dry-cleaning services versus laundry services.

Industry Key Trends and Stats

IBISWorld notes that the dry-cleaning industry displays the characteristics of an industry in the declining stage of its life cycle. This indication supports the fact that the industry's small contribution to the overall economy is expected to continue a decline at a projected annualized rate of 1.1%. Moreover, other indicators of the decline stage include falling employment, low profit margins, a consistent stream of enterprises exiting the industry and intensifying competition from substitute products and other industries.

Despite these negative trends, the industry remains highly competitive, localized and fragmented.

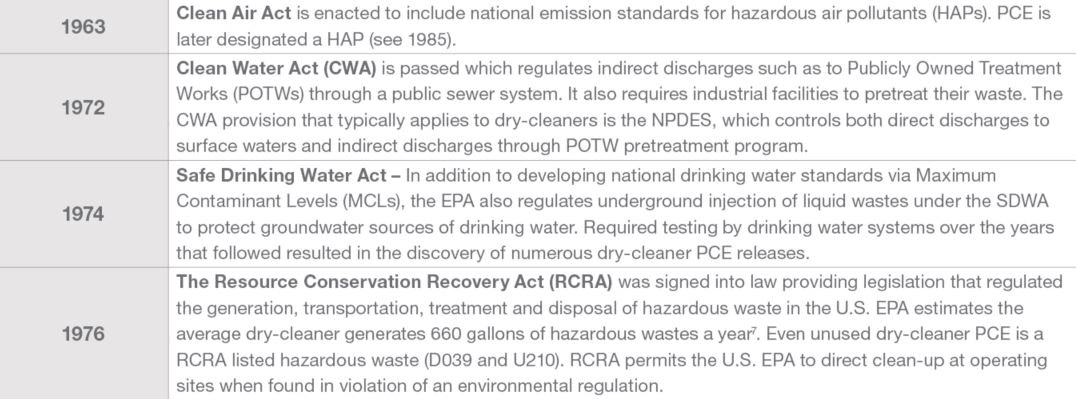

Industry Environmental Regulation

Continued tightening of environmental regulations, particularly in respect to use of PCE, will likely force many retail dry-cleaners out of the market, predominantly older single-shop facilities that still use PCE. A history of how various regulations impacted PCE use and more broadly the dry-cleaning industry6 with increasingly stringent regulation follows:

2020 Implications

State Dry-Cleaner Funds

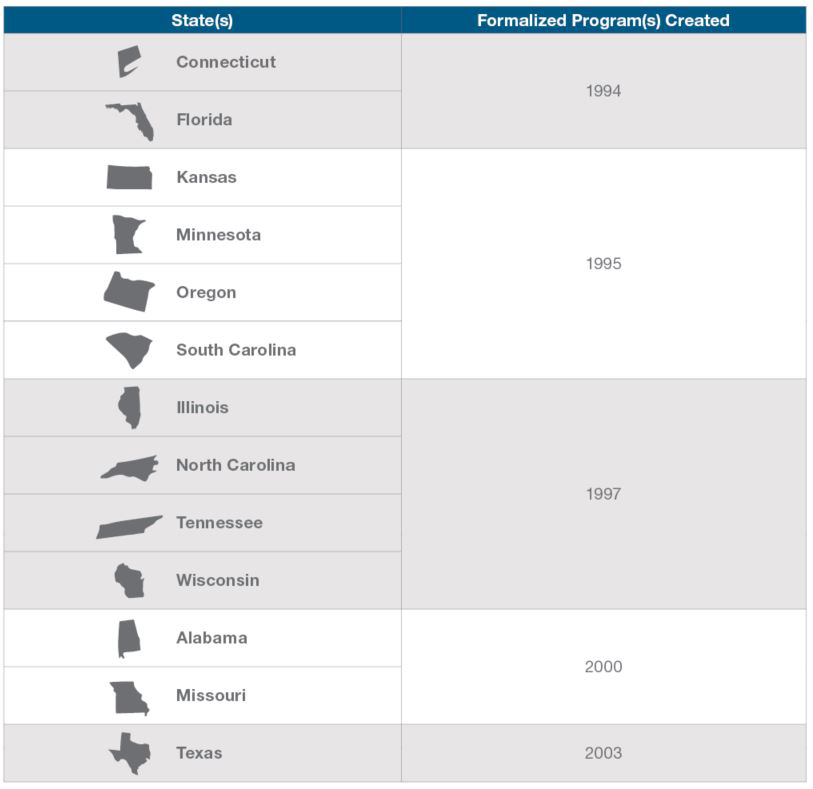

There are 13 States with formal dry-cleaner remediation programs for solvent release cleanup efforts.

Environmental Protections

As depicted above, the dry-cleaning industry is complex and presents many regulatory hurdles. As a professional working within the environmental insurance market, it is important to partner with a knowledgeable carrier who can properly help mitigate the risks described above. Contact your underwriter today to learn more about how our core products and services can help protect your clients’ dry-cleaning operations.

_web.jpg?sfvrsn=330347b1_4)

Paul Scian, Senior Loss Control Consultant, Technical Support

Great American Environmental Division

Paul is a Risk Analyst with Great American's Environmental Division. He brings over 30 years of environmental and insurance consulting experience to Great American. Paul's background includes hydrogeology and finance degrees with extensive experience in greenfield, water supply development and brownfield redevelopment. He provides technical support and training to our underwriters and is based out of our New York office.

References:

- https://www.cinet-online.com/historical-developments-in-textile-cleaning/

- https://www.enviroforensics.com/blog/the-history-of-dry-cleaning-solvents-and-the-evolution-of-the-dry-cleaning-machine/

- https://issuu.com/greenearthcleaning/docs/solvon_k4_-_dangerous_waste_classif

- https://www.inc.com/magazine/201804/bill-saporito/rinse-laundry-startup.html

- https://www.franchisechatter.com/2018/10/17/fdd-talk-2018-martinizing-dry-cleaning-franchise-review-financial-performance-analysis-costs-fees-and-more/

- https://www.epa.gov/sites/production/files/2015-01/documents/dryclean.pdf

- https://www.environmental-law.net/key-practice-areas/environmental-due-diligence/dry-cleaners-and-commercial-real-estate/#:~:text=Studies%20by%20EPA%2C%20the%20State,500%20actively%20contaminated%20sites)%3B

- https://www.sciencedirect.com/topics/earth-and-planetary-sciences/superfund-site#:~:text=More%20than%20600%20chemicals%20have,%25)%20(ATSDR%2C%201989)

- https://www.environmental-law.net/key-practice-areas/environmental-due-diligence/dry-cleaners-and-commercial-real-estate/#:~:text=Studies%20by%20EPA%2C%20the%20State,500%20actively%20contaminated%20sites)%3B

- https://www.epa.gov/sites/production/files/2015-08/documents/scrd_10_year_report.pdf

- https://www.epa.gov/sites/production/files/2015-08/documents/scrd_10_year_report.pdf

- https://www.epa.gov/sites/production/files/2015-08/documents/scrd_10_year_report.pdf

- https://envnewsbits.info/2017/09/29/perc-dry-cleaners-co-located-in-residential-buildings-must-be-phased-out-by-2020/

- https://www.govinfo.gov/content/pkg/FR-2006-07-27/pdf/06-6447.pdf

- https://www.epa.gov/assessing-and-managing-chemicals-under-tsca/draft-risk-evaluation-perchloroethylene.

- https://www.epa.gov/regulatory-information-sector/dry-cleaning-sector-naics-8123

- https://www.epa.gov/stationary-sources-air-pollution/petroleum-dry-cleaners-new-source-performance-standards-nsps

- https://www.broward.org/EnvironmentAndGrowth/EnvironmentalProgramsResources/Publications/Documents/DryCleaners.pdf