Social Inflation: How Today’s Rising Claim Costs Affect Tomorrow’s Insurance Premiums

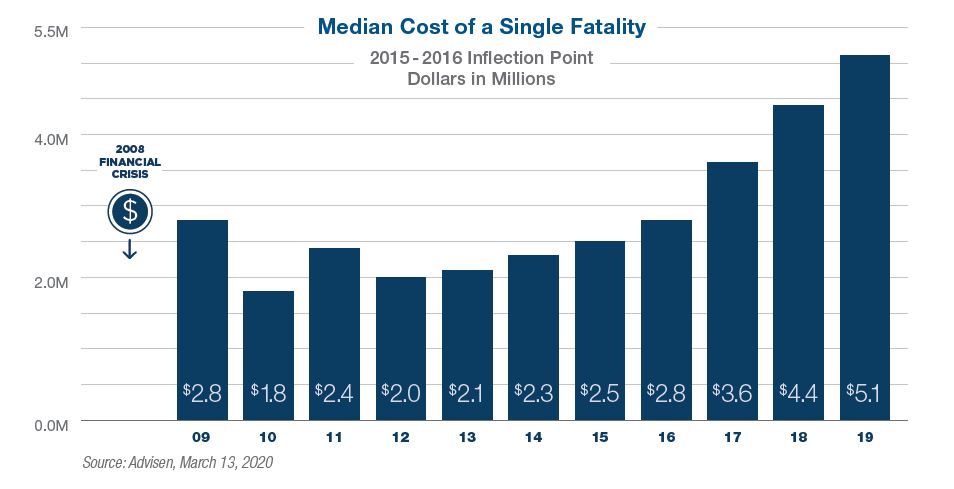

Today’s insurance premiums aim to reflect tomorrow’s predicted costs. Actuaries and underwriters continuously assess risk to forecast future costs. But what happens when claim costs grow at an exponential rate? What happens when jury verdicts frequently shatter even the highest expected outcomes?

Social inflation generally describes the rising costs of insurance claims that result from changing societal perceptions and trends. While the concept of social inflation may seem straight forward, factors contributing to the phenomenon vary widely and are difficult to identify and quantify.

Some of the most notable factors contributing to social inflation include:

Growing wealth gap

Millions of people remain jobless while the U.S. stock market achieves record-breaking highs. Media coverage of this creates juror perception that corporate executives amass wealth while low-income families suffer. This perception of income inequality may increase both the number of lawsuits and the average verdict value.

Increasing health care costs

Health care costs continue to outpace inflation. This may lead to higher compensatory awards and jurors accepting future medical costs suggested by plaintiff counsel.

“Monopoly money” effect

People hear about massive jury verdicts, such as the $4.69 billion verdict awarded against Johnson & Johnson in Missouri in 2018, as well as billion-dollar fines and penalties assessed against corporations. Legal advertisements show large plaintiff settlements and verdicts. Frequent exposure to excessive sums can normalize the idea of high-payout verdicts.

Litigation funding

Investors are pouring billions of dollars into civil litigation investments as an alternative to the stock market. The third-party funding litigation industry is a growing, multi-billion dollar industry changing the economics of the legal profession. This funding provides capital to plaintiff law firms, often makes settlement more difficult, drives cases toward trial and increases the overall cost of litigation defense.

The perceived growing inequality between “ordinary people” and large corporations leads to resentment. Political turmoil and economic struggles also make people angry. American Tort Reform Association estimates the number of legal ads increased by 30% since 2017, with 14 million ads hitting the airwaves, billboards and websites in 2019. Matching up this massive advertising effort with people’s frustrations may create a subconscious desire for wealth redistribution that manifests in the form of massive verdicts often uncorrelated to the injuries suffered. Many experts predict that jury awards will continue to grow as income inequality increases.

History has shown an increase in litigation following recessions. In the wake of the 2008 financial crisis, the stock market bounced back while hourly wages remained stagnant. Some authorities believe the stigma of frivolous lawsuits waned while the longing to punish corporations grew.

How This Affects Insurance Policy Pricing and Coverage

Insurance carriers and defense counsel work hard to combat social inflation in the courtroom. Unfortunately, increased litigation expenses and colossal verdicts continue to exceed projected costs. Social inflation forces property and casualty insurers nationwide to increase premium rates. Additionally, certain high-risk exposures, such as punitive damages and sexual abuse, may be excluded or sublimited.

The insurance industry must account for social inflation if it is to meet its customers’ needs. Actuaries and underwriters must constantly assess the threat posed by aggressive social inflation in a post-pandemic era. Until potential jurors understand that nuclear verdicts primarily harm policyholders or until legal reform addresses the problem, social inflation is here to stay.

What Can Agents and Policyholders Do

A sound risk management program can help a policyholder mitigate or prevent losses. Great American and our agents can help a policyholder better manage its risks to help combat social inflation and other exposures.

.png?sfvrsn=246522b1_1)

.jpeg?sfvrsn=dbf923b1_1)