The Start of Something Great: The Founding of German American Insurance Company

Source: Broadway near Grand St., 1870, Library of Congress

The early history of our founding company, German American Insurance, reflects many of the key trends in the country at the time: the continued rise of New York City as a financial center, the importance of immigrants to the rapid growth of the country and the desperate need for greater insurance capacity to support that growth.

As we approach our official 150th anniversary date in March, we look back to not only understand what the country, and New York specifically, looked like at this time but also get a better picture of who the people were who started this great company.

What did New York look like in the early 1870s?

While it didn’t look like what we think of today, New York was an active metropolitan center and the home to storied monied interests that came to dominate the launch of this period, dubbed the Gilded Age.

- By 1870, New York’s population had surpassed a million people.

- The city was only Manhattan Island. The consolidation of the 5 boroughs still 20 years off.

- Taller buildings were beginning to emerge in New York, reaching heights of 8-10 stories or more.

- Construction had begun on the greatest engineering project of the time, the Brooklyn Bridge.

- The Metropolitan Museum of Art opened its doors to the public for the first time in February 1872 in a building that had formerly served as a private residence and dance academy.

- On March 1 of the same year, President Ulysses S. Grant established America’s first national park, Yellowstone.

This was also a period when European immigration was booming. Since the 1830s, Germans had been migrating to the U.S. in record numbers. German farmers moved West while the urban German population grew like never before.

Who founded German American Insurance?

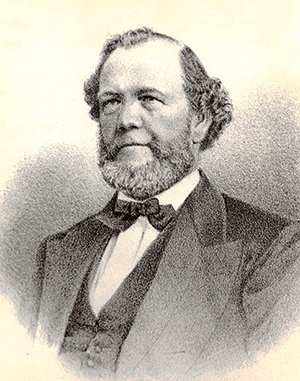

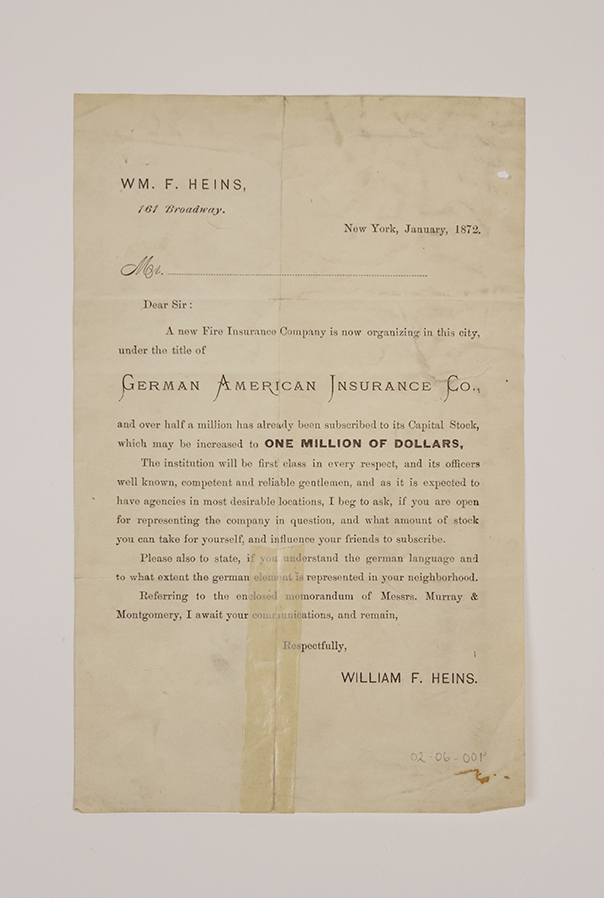

William F. Heins was a German immigrant. Born in Prussia, Germany in 1815, Heins came to this country in 1840 and became an importer until the panic of 1857, when he entered the insurance business. In 1871, he was an agent. His advertisements appeared in industry publications of the time.

Heins was in Germany at the time of the great Chicago Fire. In October 1871, fire destroyed more than half of the city of Chicago. This event rocked the insurance world because the industry was not prepared to deal with such a massive loss. The catastrophe drove more than 50 insurance companies into bankruptcy and thousands of policyholders were never compensated for their losses.

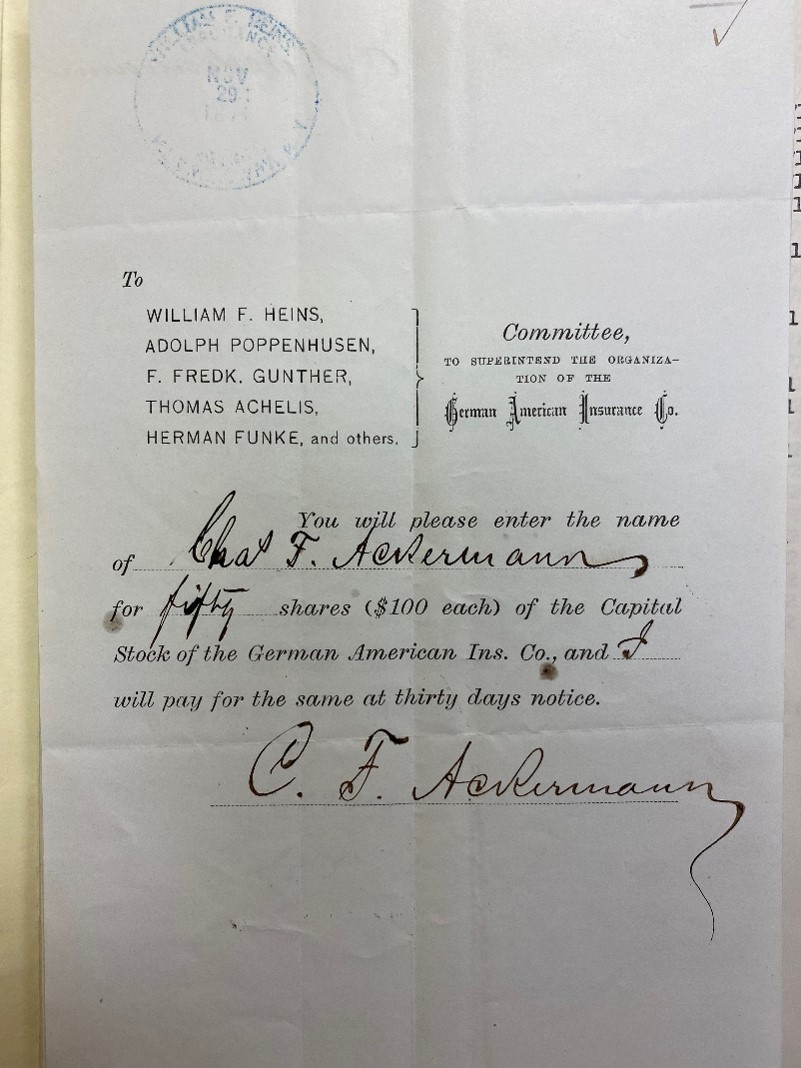

Heins recognized that the capacity of American insurers was too limited for the expanding era and saw a need for a strong new company. With important financial connections in Germany, Heins was able to secure a large subscription toward the capital necessary to launch German American. He returned to New York in November and continued to secure investors.

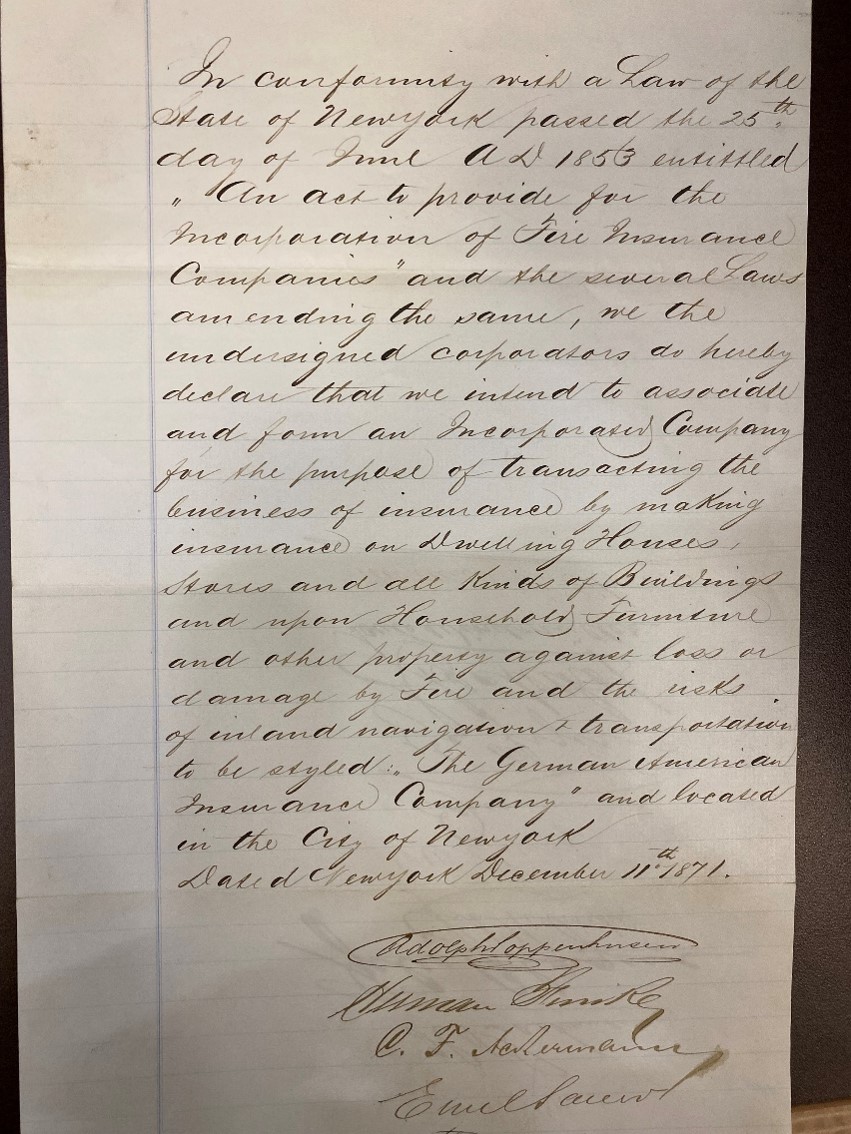

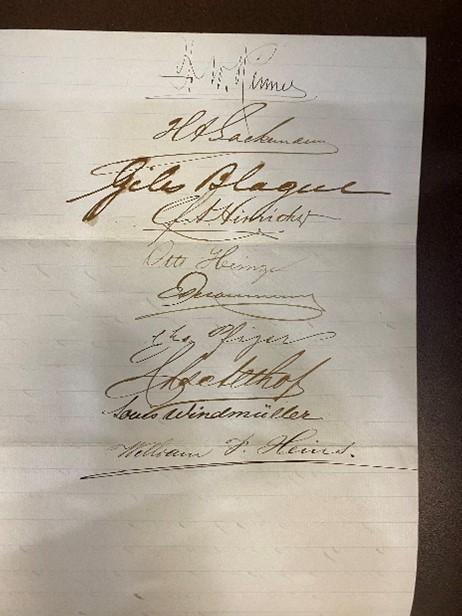

By December, 15 prominent German-American businessmen signed a declaration of intent to incorporate and issued a prospectus.

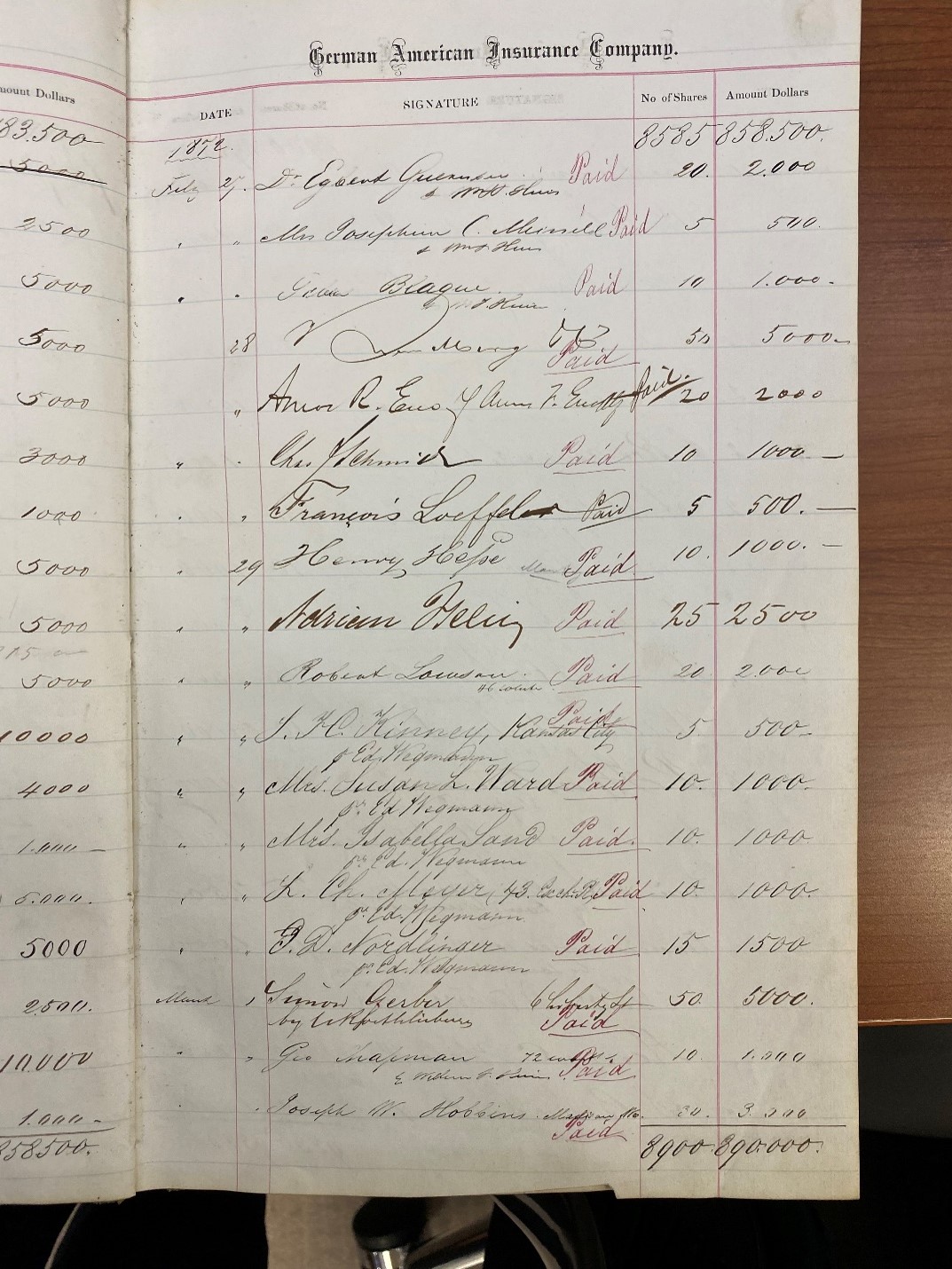

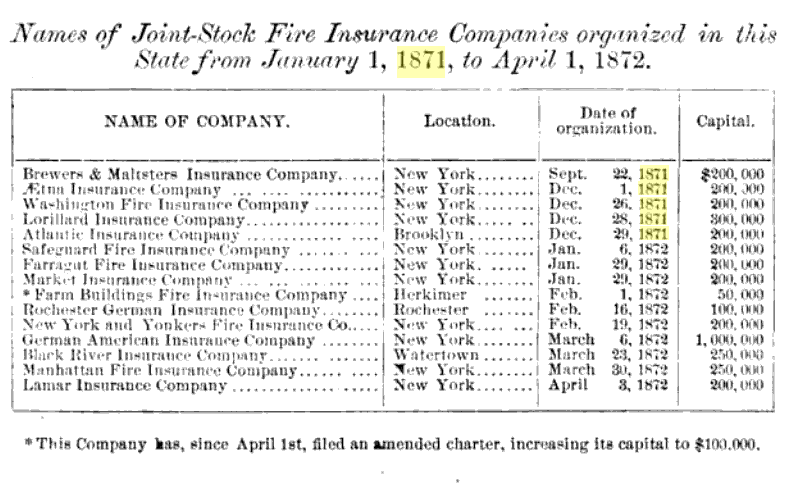

By January, the corporators of German American were halfway to their goal of $1 million in capital.

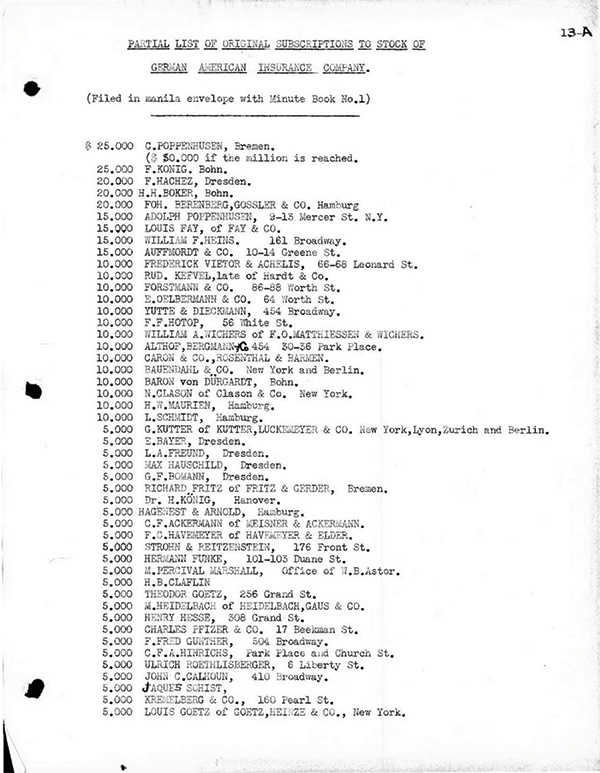

This list of original investors in the stock of German American is particularly interesting. Note the location of each shareholder and the number of Germans who contributed toward the goal. The German surnames of the American shareholders also dominate and include a number of wealthy and well-known individuals.

- Conrad Poppenhusen was considered the founder of College Point, Queens.

- His son, Adolph, was president of both the Goodyear Rubber Company and the India Rubber Comb Company.

- Charles Pfizer, who co-founded Pfizer in 1849, is also on the list.

Heins and the other directors of the company reached their goal by early March 1872. German American’s capital far exceeded any other company’s organizing at the time.

The new company was well-received by industry trade press at the time. The Industrial Monthly noted that Heins had “always been widely and favorably known among underwriters … and any institution with which he is connected as chief officer will be safely, energetically, but yet conservatively managed.” The publication went on to profess, “we know of no company which has commenced business under so favorable auspices, and which is more likely to become a national institution.” Pointing to Heins, the paid-up capital and the influential board of directors, the publication closes their write-up by saying “this company is a grand success, and we expect at no distant day to see it as widely known and respected, and its policies as eagerly sought, as those of any fire company in the world.”

Interested in seeing how Great American grew into the company it is today? Visit our Company Story to see why our yesterdays tell an important story about our tomorrow.

.png?sfvrsn=246522b1_1)

.jpeg?sfvrsn=dbf923b1_1)