When Winning Costs More Than the Prize: A Fee Dispute Claim Study

By: Millie Koppean, Great American Insurance Group, Professional Liability

Project Overview: The Insured was retained to provide architectural services for a commercial office renovation. The original design contract was a fixed fee of $35,000, with payments scheduled in phases. What initially appeared to be a straightforward project took an unexpected turn when payment issues arose.

The Dispute Emerges

Scope Changes

As the project progressed, the client requested several design modifications, such as upgrading materials and expanding the layout. The Insured verbally informed the client that these changes would incur additional costs.

Payment Issues

The Insured completed significant portions of the design; however, when the Insured submitted its payment request, the client disputed the charges asserting that the changes were minor and the original fee should still apply. Additionally, the client asserted that the design was subpar and needed further revisions.

Rising Tensions

The Insured felt trapped - reluctant to continue without payment but wary of halting work, fearing a delay claim. The Insured addressed the client’s requests and then pressed for payment, but the client ignored the Insured’s subsequent payment requests.

Legal Action and Escalating Costs

Escalating Dispute

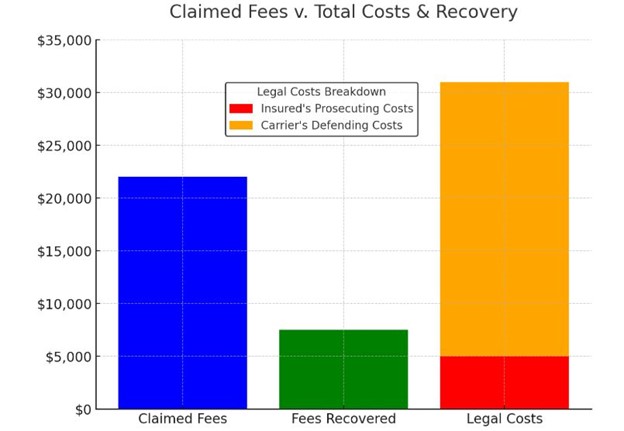

After much unproductive back-and-forth, and project completion reached, the Insured hired an attorney to pursue the overdue fees totaling $22,0001. Despite multiple demand letters, the client remained unresponsive, so the attorney filed a Mechanic’s Lien for the unpaid balance.

Client's Response

In response, the client hired their own attorney and countersued alleging the Insured’s work was deficient and had caused project delays. This led to a professional liability insurance claim with the Insured’s carrier assigning legal representation to defend against the client’s counterclaim.

Legal Costs

Legal costs quickly accumulated. Legal fees accrued from the Insured’s attorney prosecuting the fee claim, the attorney appointed by the Insured’s insurance carrier defending against the client’s counterclaim, and the client also incurred fees for its attorney to contest the fee claim.

The Outcome

Settlement

After over a year of legal wrangling, the case finally settled - but it was a hollow victory for both sides. The total cost of litigation exceeded the amount at issue. The Insured received only a fraction of the $22,000 fee. The client agreed to pay $7,500 and drop its counterclaim. However, the Insured incurred $5,000 in legal fees to pursue payment, with $26,000 spent defending against the counterclaim.

The Total Cost of the Dispute

This claim illustrates how legal battles can easily overshadow the original claim. Strong fee collection practices, contract clarity, and proactive communication are key to avoiding such costly and disruptive disputes.

Key Takeaways

🛡️ Protecting Your Fees in Design Contracts

A well-structured contract minimizes disputes by clearly defining:

✔️ Scope of Services – What is included, excluded, and the process for change orders.

✔️ Pricing Structure – Select the best fit for the project: Fixed Fee, Hourly, or Percentage-Based.

✔️ Payment Terms – Enforceable terms to prevent legal escalation.

✔️ Ownership of Documents Clause – The ownership of the instruments of service do not transfer unless all fees and reimbursables are paid.

📏 Managing Expectations & Avoiding Scope Creep

✔️ Document scope changes early and agree on additional fees in writing upfront.

✔️ Scope creep can lead to misunderstandings, unpaid work, and disputes.

💰 The Importance of Fee Collection Practices

✔️ Enforce timely payments at each project milestone to avoid prolonged disputes.

✔️ Secure upfront payments, when possible, to reduce risk and improve cash flow.

⚖️ Weigh the Cost of Legal Action

✔️ Fee disputes often cost more than they recover.

✔️ Weigh potential recovery against legal costs and counterclaims before pursuing unpaid fees.

Millie Koppean is a Financial Products Claims Examiner at Great American. Prior to joining Great American, Millie served as senior claims counsel for a third-party claims administrator handling a variety of professional liability claims for Underwriters at Lloyd’s of London and domestic carriers. She earned her law degree from The John Marshall Law School.

The financial figures presented in this claim study have been rounded for ease of calculation and illustration.

.png?sfvrsn=246522b1_1)

.jpeg?sfvrsn=dbf923b1_1)