Risk Management - The Role of Risk Control in Identifying and Mitigating Environmental Exposures

As your broker will tell you – identifying and qualifying your exposures are the first steps in developing an effective risk management program. Once the risks associated with your business are understood, then appropriate management alternatives can be considered, selected, tested and implemented as needed.

Risk control plays a key role in an insured’s risk management program, both in identifying the potential exposures, and mitigating those exposures using best management practices.

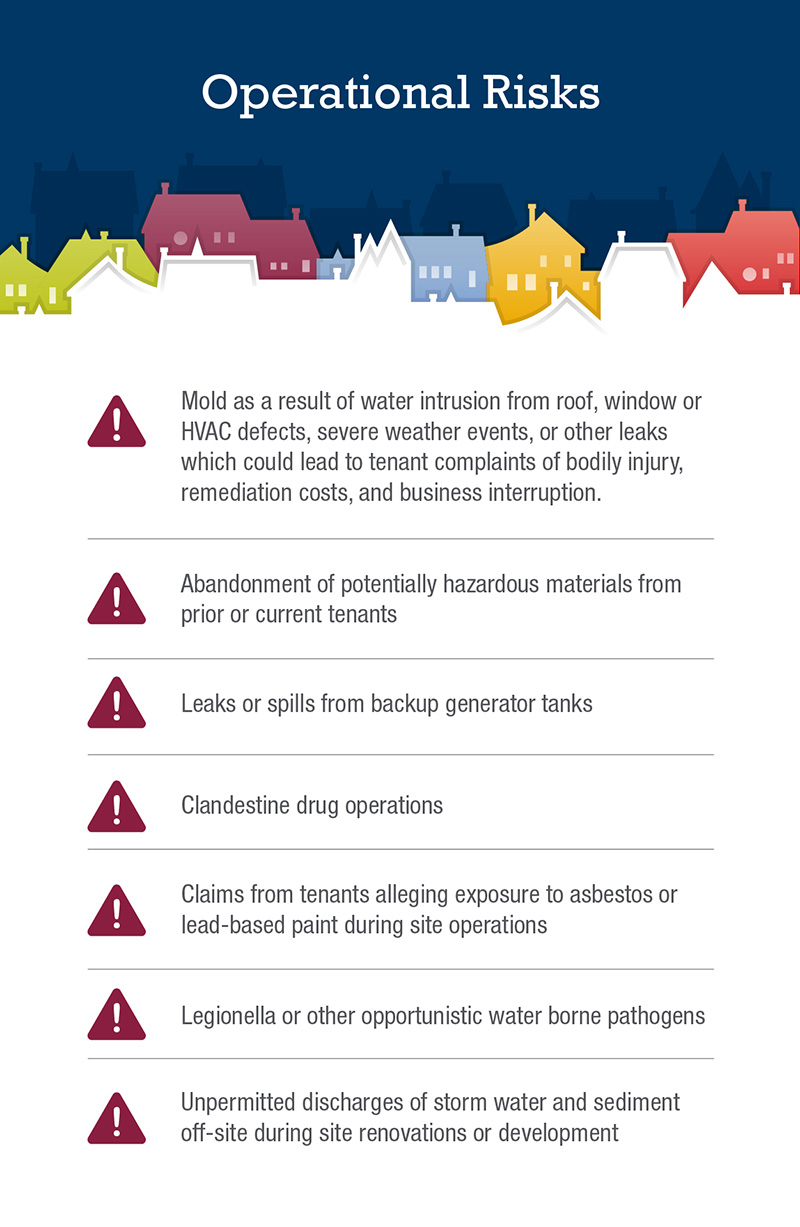

As an example – let’s look at a typical real estate portfolio that includes apartments, offices and warehouse distribution centers. Typical operational risks associated with these properties can include:

Other risks can include pre-existing conditions related to prior operations at the site, including former dry cleaners, gas stations, landfills, or other prior industrial operations, or being named a potentially responsible party at a superfund site due to past or current disposal of wastes at a non-owned disposal site (NODS).

How does a risk manager get their arms around all of these exposures?

Pre-existing conditions: Robust due diligence procedures are the first line of defense in protecting the insureds' assets and future exposures, particularly for pre-existing conditions. Prior to acquiring a property, an ASTM compliant Phase I Environmental Site Assessment Report should be developed by a qualified environmental professional. A Phase I report prepared in accordance with these standards can also provide additional protection under CERCLA. In addition to being a requirement for many lenders and financing entities, the findings of a Phase I (or Phase II if intrusive work is performed) will also provide the basis for environmental underwriting of site pollution liability policy.

Mold: A thorough water intrusion and mold prevention and management plan is the first line of defense for an insured. Mold claims (both clean up and third party bodily injury claims) are a high frequency environmental claim event that can be devastating for a property owner. Although your environmental site policy will often provide mold coverage, the coverage will be subject to a self-insured retention, and may also be subject to other restrictions such as no coverage during capital improvements or in vacant structures. Risk control can again provide a mechanism to understand and mitigate the insureds’ exposures. The first line of defense against mold is PREVENTION. To prevent mold growth, prompt identification of water intrusion, remedy of the source of water, and removal of wet materials is paramount. In addition, an established protocol to educate staff and tenants on the importance of reporting water events, leaks, and the presence of suspect mold growth is critical. Timely response and appropriate documentation can also help to ward off potentially disgruntled tenants who may otherwise claim bodily injury.

Similar to mold, a water management plan to prevent legionella, and asbestos containing material and lead-based paint operation and maintenance plans are also risk management tools which may be required based on the use, age, and construction of the building.

Periodic tenant inspections are an effective risk management tool. Pre- and post-lease inspections, in addition to periodic audits during the period of a lease, can identify if the operations are in compliance with any lease restrictions on hazardous materials use or management, housekeeping, or building conditions which could lead to water intrusion or mold.

Contractor selection and contractual requirements also provide additional protection to the insured. Contractors (especially those who service tanks associated with backup generators or fuel oil, or those involved in building demolition, renovation, or maintenance) should carry appropriate contractor’s pollution liability insurance, so that if they cause or exacerbate a pollution condition, there is appropriate coverage in place to remedy the issue and any associated business interruption.

In addition to the risk control protocols outlined above, a good risk management program will include appropriate risk financing alternatives, most commonly environmental pollution liability policies.

As added value to our insureds, Great American Environmental can assist in developing and evaluating risk management programs to complement and enhance the insured’s risk management program. Services include review and evaluation of existing prevention plans (mold, ACM, legionella etc.), preparation of new plans, on-site or webinar based training, evaluation of due diligence procedures, and on-site post-bind site reviews to evaluate and recommend best management practices. Our Technical Support team has more than 90 years of combined experience in the environmental industry, supplemented by key outside suppliers with specialized expertise in emergency response, industrial hygiene, safety, remediation and compliance.

Sara Brothers

Sara is a Divisional Vice President with Great American Environmental. She brings more than 30 years of environmental consulting and construction management experience to Great American. Sara’s background is as a senior geologist with extensive consulting and industry experience in the petroleum, industrial, commercial, and government sectors. Sara serves as the director of technical support and training. She is based out of our New York office.